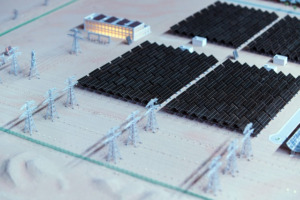

A fund has been set up to invest in and put solar power assets on the roofs of the UK’s factories and offices.

Atrato Onsite Energy (LON:ROOF) intends to raise around £150mln when it lists at the end of November.

The plan is to set up power purchase agreements with occupiers of the buildings, thereby avoiding grid losses and giving traceability of supply it said.

Juliet Davenport, chair said: “The UK’s binding net zero emissions target in 2050 and the resulting future demand for green energy means that additional generation from low carbon sources such as rooftop solar is growing.

“The company will play a leading role in providing new green power capacity, delivering businesses a dedicated clean energy supply at a low fixed cost.

Atrtato added it will use origination premiums (driven by creating new project opportunities) and conservative leverage to reduce the project-level cost of capital to less than 40% of the cost/gross value.

The trust is targeting an initial dividend of 5p and an annual total return of 8-10% in its first year and over the medium term.

A pipeline of projects worth £300mln is already in place, with £50mln under exclusivity with Atrato, and the proceeds are expected to be deployed and/or committed within 12 months from IPO.

“The portfolio is projected to save 50,000 tonnes of CO2 equivalent per annum. Expected to qualify for the London Stock Exchange’s Green Economy Mark from IPO, recognising that the company will derive 50% or more of its annual revenues from products and services that contribute to the global green economy.

Atrato’s team has 50 years of combined renewable energy experience and has worked on over 300 solar rooftop installations, it added.