Maxeon Solar Technologies, the solar panel manufacturing spinoff of installation company SunPower, has a complex American origin story, but its modules aren’t especially popular in the United States. The organization is trying to change that by increasing production at its Mexican module assembly plants and scoping sites for a U.S. manufacturing hub. The demand is there, said Maxeon CEO Jeff Waters in an exclusive Solar Power World interview, but of course everything is dependent on U.S. trade laws and climate legislation.

Since the split from SunPower in 2020, Maxeon has only had access to the U.S. residential and small commercial market through its exclusive supply agreement with SunPower. Through the end of 2022, SunPower dealers can only install Maxeon panels and Maxeon can’t work with any other U.S. residential installers. Beginning in 2023, Maxeon will have the ability to sell products into the residential market and SunPower will have the option to source non-premium panels from other manufacturers.

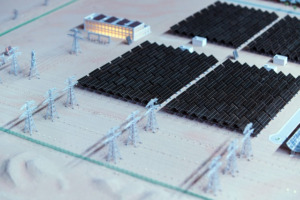

Solar panel assembly at Maxeon’s facility in Mexico

In the utility-scale market, Maxeon has mostly been shut out due to its Chinese manufacturing partners. When Maxeon set out on its own, it received an investment from Chinese silicon wafer manufacturer Tianjin Zhonghuan Semiconductor Co. Through the joint-venture, Maxeon has a steady supply of wafers and the ability to assemble modules nearby. That Chinese involvement has made Maxeon’s entrance into the U.S. utility-scale market difficult.

“By virtue of them being produced in China, we really couldn’t sell them into the U.S. because of tariffs and AD/CVD, so we’ve been excluded from the U.S. market,” Waters said. “Soon after we spun off, we started looking into the potential for us to build a panel for that Performance series that could go into the U.S.”

Maxeon has two product families: Maxeon solar panels for residential and light commercial, and Performance solar panels for cost-sensitive markets and utility-scale installations. The Maxeon panels use interdigitated back contact (IBC) technology and are the premium panel class that SunPower installers are familiar with. The Performance line uses shingled, mono-PERC cells and has a bifacial offering.

To get the Performance panels into the U.S. utility-scale market, Maxeon shifted production of PERC cells to its Malaysian facility and expanded its module assembly capacity at its plant in Mexicali, Mexico, to 1.8 GW. Taking production out of China has already led to major U.S. supply contracts: Cypress Creek has agreed to take 300 MW, Origis Energy and Total Energies both signed for 400 MW each and the nearly 1-GW Gemini project outside Las Vegas will use Performance panels.

Solar panel assembly at Maxeon’s facility in Mexico

“This gives us a great avenue into the U.S. that allows us to sell cost-competitively and avoid a lot of the tariff issues,” Waters said. “We found there …….